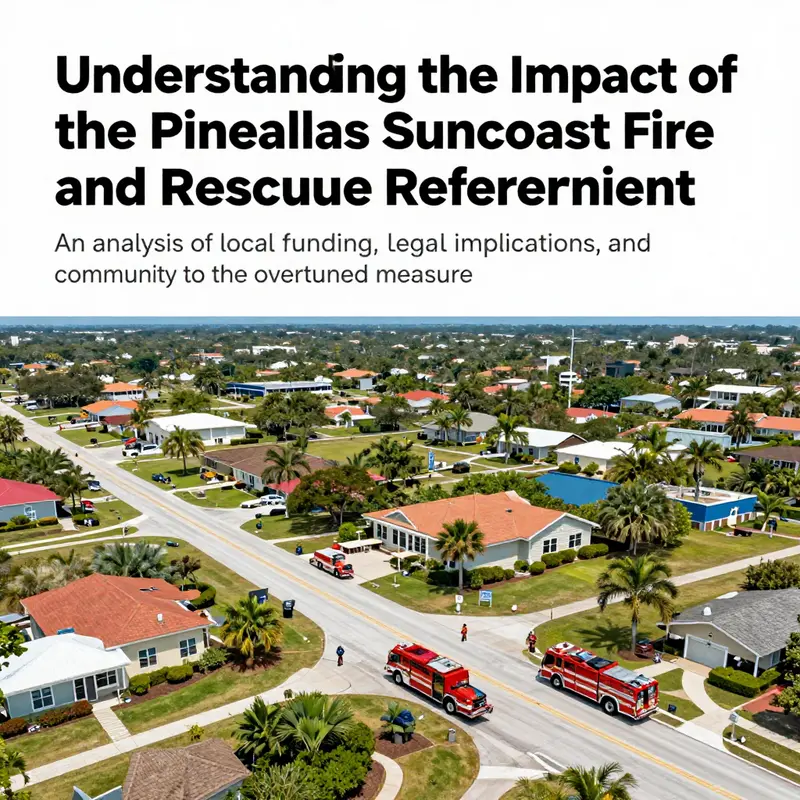

The Pinellas Suncoast Fire and Rescue District referendum aimed to bolster financial support for local emergency services through a property tax increase. However, the subsequent court ruling that nullified this measure has significant implications for the community, local funding, and residents, including individual car buyers, auto dealerships, franchises, and small business fleet buyers. This article will explore the essence of this referendum: its funding intentions, legal ramifications stemming from the court’s decision, and community responses, providing a thorough understanding of its importance for local stakeholders.

A Test of Local Trust: How a Court-Overturned Fire District Referendum Redefined Community Funding and Public Safety

When a community gathers to decide how to fund essential services, the outcome carries more than votes or numbers. It becomes a reflection of shared expectations about safety, fairness, and the proper use of public resources. The Pinellas Suncoast Fire and Rescue District referendum, decided by the ballots of local residents, was one such moment. On the surface, it looked like a straightforward request: approve a modest property tax increase to bolster fire and emergency medical services, equipment upgrades, and staffing needed to meet the district’s evolving demands. Beneath that surface, however, stood deeper questions about how communities frame fiscal choices, how they communicate those choices to voters, and how the legal framework surrounding referenda constrains what a local government can attempt to do in the name of public safety. In 2017, a judge overturned the measure, tossing out the plan to lift a tax to fund enhanced fire and rescue capabilities. The board of the district chose not to appeal the ruling, a decision that effectively ended that particular effort to secure new revenue through a direct vote. The immediate consequence was clear: no new tax, no new revenue stream, and no immediate changes to the district’s ability to finance expanded or upgraded services. But the implications ran deeper, especially for residents who rely on prompt and dependable fire and EMS responses and for a community that must balance ambitious public safety goals with responsible budgeting and formal compliance with state law. The case invites a broader reflection on how referenda function in practice, how legal procedural standards shape outcomes, and what the episode teaches about the durability of funding for essential public services when a legal circuit closes on a hoped-for funding mechanism.

The fundamental idea behind any referenda aimed at public safety funding is simple enough: give residents a direct channel to decide whether to dedicate more of the tax base to the services on which they rely. In Florida and many other states, fire protection and emergency medical services are explicitly tied to property tax mechanisms that enable districts to plan capital investments, hire and retain personnel, and maintain the equipment that keeps responders ready. The arbiters of that plan—local boards and election officials—must navigate a precise set of rules about how a question is presented to voters, how much information is provided, how long the voting window remains open, and how the language of the ballot is crafted so that the intent is clear and the measure is not confusing or misleading. When a court steps in and reverses a referendum, it is often because the judge determines that one or more of these procedural elements did not meet the required standards. While the specific grounds of the Pinellas Suncoast decision are not exhaustively detailed in the public summaries available, the description makes the core point plain: the process did not align with the legal requirements for such a measure, and that misalignment was sufficient to annul the outcome.

That outcome is chilling in one sense and clarifying in another. It is chilling because residents in a district that already bears the burdens of taxation see the anticipated uplift in property taxes vanish on a courtroom ruling, and the service providers lose a scheduled infusion of capital that might have translated into new hiring, new equipment, or modernized facilities. It is clarifying because it stresses a fundamental truth about local governance: the authority to fund essential public services through a ballot measure is not a unilateral grant. It rests on a set of carefully followed procedures intended to protect voters, ensure transparency, and align revenue-raising with lawful, well-communicated language and notification practices. When those guardrails fail to meet scrutiny, the result is not a flexible path to improvement but a reset that keeps the current funding structure intact. In the Pinellas case, the district’s decision not to pursue further legal action underscored a public acknowledgment that, at least for the time being, the path to increasing funding through a direct vote was not admissible under the existing procedural framework. That does not necessarily foreclose future efforts; it reframes them. Any new attempt would likely require a meticulous re-examination of ballot language, updated public notices, and perhaps a redesign of the information package presented to voters so that the measure stands a better chance of withstanding judicial review.

The broader significance of this episode lies not only in what happened, but in what it reveals about the relationship between funding, governance, and frontline public safety. Fire districts operate within a web of immediate service demands and long-range capital needs. They must ensure that engines stay in serviceable condition, that PPE and medical equipment meet evolving standards, and that crews have the training to handle a wide range of emergencies with competence and compassion. When a funding mechanism is placed before the public, the district must anticipate a spectrum of outcomes—from broad support to stiff opposition—to avoid leaving the community under-resourced if the measure fails, or overcommitting when revenue is uncertain. In a climate where revenue predictability is a linchpin of safety planning, the absence of new funding streamed through a referendum raises practical questions about budgeting, staffing levels, and equipment upgrades. A district cannot simply assume that a favorable vote will secure everything it thinks it needs; it must instead framework its plans with an eye toward long-term stability, cost growth, and contingency strategies for lean years.

If residents hoped for a shiny inflection point in their fire and rescue capabilities through the referendum, the court’s ruling did not deliver it. Yet the experience can fortify civic understanding about how public safety funding actually works in practice. It invites voters to consider the tradeoffs involved in choosing higher local taxes against other potential funding sources, and it invites district leaders to design processes that are robust enough to survive legal scrutiny while still being clear and accessible to the public. This means not only constructing a ballot question that precisely reflects the fiscal impact but also providing voters with a transparent explanation of how the funds would be used, what benchmarks would be met, and how accountability would be maintained if the measure passed. In short, it is a reminder that the peace of mind that comes with strong fire and rescue services is built not only through budgets and gear, but through the integrity and clarity of the democratic process that governs those budgets.

For residents and stakeholders, the immediate aftermath is operational as well as political. With no new revenue, the district would continue to rely on its existing funding streams, whose adequacy is measured by current staffing, fleet readiness, equipment replacement schedules, and the ability to respond to emergencies in a timely fashion. When funding structures do not expand, districts face difficult decisions about how to allocate limited resources. They may need to prioritize core operations over enhancements, or to defer certain upgrades until funds are available through other means. The result is a practical tightening of options that affect the speed and breadth of preparedness. It also places a premium on the efficiency of existing programs—how well the district utilizes its current resources, whether there are ways to optimize administrative overhead, and whether partnerships with other municipal agencies or regional programs could temporarily augment capacity without new tax revenue. In this sense, the referendum episode becomes a catalyst for deeper questions about how to deliver reliable, high-quality emergency services with finite resources while maintaining public confidence that those resources are used prudently and transparently.

From a governance perspective, the decision not to appeal the ruling sends a signal about the district’s assessment of the legal landscape and its tolerance for ongoing litigation costs. Choosing not to pursue further action can reflect a pragmatic calculus: the likelihood of success, the potential for any additional financial exposure, and the opportunity costs of continuing a legal dispute. In the context of public safety, courts may be the arena that defines not just how money is raised, but how money is scrutinized and how it must be allocated. The decision also highlights the real-world consequences of compliance and procedural rigor. When rules are followed, funding plans are less vulnerable to post-hoc legal challenges; when they are not, the consequences ripple through planning cycles, procurement timelines, and recruitment schedules. The absence of an appeal may be interpreted as a commitment to procedural discipline and a recognition that the district would rather pursue future opportunities through channels with clearer legal footing than engage in renewed, protracted litigation that could delay critical readiness.

In thinking about the future, communities facing similar questions can draw two main conclusions from the Pinellas Suncoast episode. First, referenda can be powerful tools for securing community-backed funding for essential services, but their power is bounded by the legal framework that governs how questions are framed, advertised, and certified. The message for any district contemplating a ballot measure is to prioritize crystal-clear language, robust voter education, and meticulous adherence to legal requirements from the outset. Second, a failure to secure funding through a referendum is not necessarily a failure of the community’s commitment to public safety. It is, rather, a prompt to pursue alternative strategies that preserve service levels without sacrificing compliance. These strategies could include direct board decisions within existing budgets, targeted capital funding through reserves, or blended approaches that combine smaller, incremental tax adjustments with grant investments. In that sense, the Pinellas case becomes less a cautionary tale about taxation and more a case study in how to negotiate the inevitable tension between democratic choice and legal accountability when the subject is public safety.

The chapter on what the referendum means, then, is not simply a record of a failed ballot measure. It is an invitation to look at how a community values safety, how it structures accountability for the funds it spends, and how it ensures that the mechanisms for funding do not become obstacles to timely protection. It is about designing processes that protect both the taxpayers and the people who respond to emergencies with courage, training, and skill. It is about recognizing that the safest communities are not only defined by high budgets or rapid responses, but by the clarity and integrity of the decisions that govern those capabilities. As residents, officials, and service providers reflect on this episode, they are reminded that the work of public safety is both about the men and women who stand ready to act and about the systems that enable them to do so consistently, transparently, and with public endorsement that stands the test of court scrutiny.

For readers seeking a broader lens on how training and certification contribute to a district’s readiness even when funding changes are uncertain, consider the resources on FireRescue for a practical look at how ongoing education underpins day-to-day performance. Fire Safety Essentials Certification Training provides a window into how responders maintain readiness through structured learning paths, reinforcing the idea that preparedness is a continuous process that extends beyond the constraints of a single funding cycle. This emphasis on training complements the funding discussion by highlighting a parallel track of public safety resilience: even when new revenue isn’t approved, the dedication to personnel development remains a core investment in community protection.

For readers who want to anchor these reflections in the documented legal record, the Belleair article offers a contemporaneous account of the ruling and the district’s decision not to pursue further appeal. The piece details the court’s conclusions and the district’s response, serving as a tangible reference for understanding how procedural standards shape outcomes in real-world governance. You can explore the reporting in the Belleair article here: https://www.belleair.com/2017/10/17/fire-district-wont-appeal-referendum-ruling/

In sum, the Pinellas Suncoast Fire and Rescue referendum episode serves as a reminder that the work of protecting a community is a marathon of planning, accountability, and legal due diligence as much as it is a sprint of fundraising and public engagement. The district’s experience underscores that funding for fire and rescue services is not guaranteed by public approval alone; it hinges on disciplined processes, transparent communication, and the readiness to explore alternative paths when the legal landscape alters the likely course of action. It invites residents to consider not only whether a tax increase should be adopted, but how the public and its leaders can collaborate to ensure that emergency services remain funded, modernized, and capable of meeting the evolving demands of a changing community. By embracing this broader perspective, communities can better prepare for future opportunities to invest in safety in ways that withstand legal scrutiny while still delivering the reliable, timely care that every neighbor deserves.

Crucible of Public Trust: The Pinellas Suncoast Referendum, Law, and the Quiet Stakes of Fire Safety

When a local fire district proposes a tax increase through a referendum, the outcome is seldom a simple yes or no on a single policy. It becomes a test of faith in how power is exercised, how rules are followed, and how communities balance the immediate needs of public safety with the longer arc of lawful governance. The Pinellas Suncoast Fire and Rescue District referendum, which sought to raise funds for fire and emergency services through a property tax increase, unfolded as such a test. It began with a straightforward premise from the district’s board: to ensure equipped, timely, and reliable emergency response in a growing region. It concluded in a way that reinforces a core truth about modern governance—the integrity of the process matters at least as much as the outcome. The court’s decision to overturn the referendum and the district board’s choice not to appeal did not merely erase a ballot question from the record. It underscored crucial boundary lines in the law that shape how communities can raise revenue for essential services and how those revenue decisions relate to the public trust.

To understand what happened, one must first grasp the legal scaffolding that supports or restricts the ability of special districts to levy taxes. Special districts, including a fire and rescue district, operate with powers that are explicitly defined by state law. In Florida, those powers are not blanket permissions but carefully circumscribed authorities. The legal foundation for a referendum of this kind rests on demonstrating a genuine financial need that existing revenue streams cannot meet, coupled with a lawful process that respects constitutional provisions and statutory requirements. This is not a matter of political preference but of legality: tax authority anchored in statute, validated by public participation, and bounded by oversight. The district’s argument for increased funding would have required, among other things, a credible, documented presentation of need—a budgetary analysis or financial report that makes clear why current revenues fall short and why the proposed tax increase is a necessary mechanism to fill that gap. The idea of a funding gap is not controversial in itself; the challenge arises in how that need is documented, presented to voters, and subjected to independent scrutiny so that the public can evaluate the claim with confidence. What followed was a sequence of procedural steps, each one a potential point of vulnerability in the eyes of the law. If any of those steps deviated from the established protocol, the referendum’s fate could be jeopardized, not because voters decided against it, but because the process that brought it to the ballot did not perfectly align with legal mandates.

The legal protocols governing referenda in Florida are intentionally exacting. They begin with public notice, a foundational step that ensures residents know a consequential vote is on the agenda. Adequate notice is more than a calendar entry; it is a guarantee that the community can prepare, inquire, and participate. Then comes ballot language, a technical but powerful gatekeeper. The wording must be clear, unambiguous, and comprehensible to a broad audience, avoiding misinterpretation that could mislead voters or manipulate outcomes. Voter eligibility is another critical element—the roster of who is permitted to cast a ballot on that measure must be accurate, up-to-date, and verifiable. Lastly, the approval threshold—often a simple majority of those who vote—conditions the outcome on actual participation and informed decision-making, rather than on the quiet power of a few.

In the Pinellas Suncoast case, the court ruled that the referendum violated certain procedural or statutory standards. The exact legal grounds are not detailed in the summary available, but such rulings commonly hinge on whether proper notice was given, whether the ballot language met statutory standards for clarity and neutrality, whether the timing of the vote respected constitutional and statutory timelines, or whether the process adequately safeguarded voter eligibility and campaign finance disclosures. The court’s decision to overturn signals that, in this instance, the procedural mechanism through which the tax increase would have been proposed, debated, and approved did not satisfy the law’s requirements. That is not an indictment of the public’s willingness to fund emergency services, but a reaffirmation that the process by which such funding is sought must be transparent, predictable, and subject to review. The district’s decision not to appeal the ruling further emphasizes a commitment to upholding the rule of law over the strategic advantage of a legislative win, at least in the immediate sense. It sends a message that, in this jurisdiction, the integrity of the process carries weight independent of the desirability of the outcome.

Transparency is a central thread in discussions about public finance, particularly when the issue concerns essential services like fire protection and emergency response. The district’s obligations extend beyond presenting a compelling case for funding. They require ongoing transparency about how funds would be used, how long the funding would last, and how accountability would be maintained to ensure that revenues are dedicated to stated purposes. Campaign finance, too, sits within the orbit of transparency. The public must be able to see who is supporting or opposing the measure, what messages are being promoted, and how those messages align with actual fiscal plans. The legal framework envisions a scenario where voters can weigh the potential impact on their wallets against the demonstrated need for enhanced services, while also assessing the credibility of the information presented by proponents and opponents alike. When a referendum falters in court, it is a reminder that truth in budgeting is inseparable from truth in process. Critics may argue that a denial of the tax is a denial of public safety; supporters may insist that the process itself is the best safeguard against misallocated or misrepresented funding. The truth lies in a careful balance between securing dependable emergency services and preserving the procedural checks that keep public budgeting honest.

The practical implications of this legal dynamic ripple through the community in several ways. For residents, the immediate effect is the absence of a new tax increase that could have translated into expanded fire suppression capacity, updated equipment, enhanced training, or more robust emergency response infrastructure. Yet the absence of a tax increase does not automatically translate into a clean slate for funding alternatives. The district, and indeed any local government entity, must still contend with the budgeting realities that shaped the referendum’s inception. If the district experienced a persistent funding gap, it would need to pursue legal, transparent avenues to address it—avenues that comply with the same rules that governed the referendum process. This could include refining financial reporting to make the financial need more transparent, seeking alternative funding strategies within the law, or engaging in a renewed, legally sound process that would again ask the public to weigh the fiscal responsibility of higher taxes against the tangible benefits of stronger fire and emergency services.

For the public, the episode underscores a broader principle: the risk of political or fiscal shifts may be tempered by the strength of the legal guardrails surrounding tax measures. When citizens participate in referenda, they are not simply voting on outcomes; they are validating the framework that governs how those outcomes are chosen. The court’s intervention and the district’s decision not to pursue further legal action can, paradoxically, reinforce trust by illustrating that rules matter and will be enforced, even when the stakes involve public safety funding. It invites residents to consider not only the question of whether more funds should be devoted to fire and rescue services but also how the district communicates its needs, how it measures the impact of its spending, and how it ensures that the information available to voters is thorough, accurate, and accessible. In this light, public engagement becomes as essential as public money.

The chapter of governance that this referendum touched upon is not merely about taxes or firefighting equipment. It is about the health of a civic ecosystem in which budgets are debated in the light of evidence, where ballots reflect carefully drafted language, and where the courts stand as guardians of due process. The district’s experience—seeking funding, encountering legal boundaries, facing overturn, and ultimately choosing not to appeal—offers a case study in how the rule of law and the practical realities of public safety intersect. It invites a more nuanced conversation about how communities can plan for emergencies in a landscape of finite resources, how they can hold agencies accountable for spending, and how they can maintain confidence that the path to stronger services respects the rules that keep the system fair for everyone.

As residents and leaders reflect on the episode, several lessons emerge that can guide future efforts. First, any attempt to raise revenue for public safety must be anchored in rigorous financial analysis that stands up to scrutiny by oversight bodies and the public alike. This means transparent documentation of the current funding gaps, the projected benefits of the proposed increase, and a detailed plan for how funds would be allocated. Second, the process must be designed with a clear, compliant, and accessible path to the ballot. Adequate public notice, precise ballot language, and careful attention to voter eligibility cannot be treated as peripheral tasks but as integral components of the measure’s legitimacy. Third, there must be robust disclosure around campaign finance and communications related to the referendum, ensuring that voters can separate well-supported information from misleading rhetoric. Fourth, there should be a built-in mechanism for accountability that remains in place after any measure passes or fails. If a tax increase were approved, there would need to be sunset provisions, periodic review, and transparent reporting on outcomes and expenditures. If a measure is not approved, communities should still receive a candid assessment of the district’s funding needs and a thoughtful outline of alternative, lawful options.

In this sense, the Pinellas Suncoast case is not simply a story about a court ruling or a political contest. It is a narrative about how public safety, fiscal stewardship, and citizen involvement converge in a modern democracy. It invites readers to consider the delicate craft of governance: forecasting risk, communicating with clarity, and designing processes that allow communities to decide with confidence that their dollars will be stewarded responsibly. The chapter of public finance that deals with emergency services is, at its core, a chapter about trust—how it is earned, how it is scrutinized, and how it endures when difficult decisions must be made. The decision to overturn the referendum, and the district’s choice not to appeal, can be read as a reaffirmation that trust in a democratic system is protected not only by the outcomes it produces but by the fidelity of the path that leads to those outcomes.

For readers seeking an example of how theory translates into practice—how legal theory of taxing authority and procedural compliance interacts with the real-world duties of fire protection and emergency readiness—the Pinellas Suncoast episode offers a sober reminder. It shows that funding critical services is as much a matter of governance as of dollars and cents. It shows that communities must balance expediency with legality, urgency with transparency, and ambition with accountability. It also points to the ongoing work of public safety professionals, municipal leaders, and residents who must continually navigate the complex current of public finance. In this ongoing journey, the emphasis remains on building systems that can weather both financial storms and legal scrutiny, while preserving the ability to respond when emergencies arise.

For those who want to explore the practical side of safety training and its connection to public investment, resources that discuss foundational concepts in safety culture and training may illuminate how districts envision using revenues to strengthen readiness. For instance, more information about the role of training and safety culture in emergency response can be found in broader discussions of safety education and professional development, which reinforce the idea that funding decisions should support not only equipment and personnel but also the knowledge and competencies that keep communities and responders safe. This linkage between fiscal planning and professional preparedness helps explain why referenda are not merely financial instruments but statements about a community’s commitment to resilience and preventive care. It also frames a larger narrative about how public agencies justify the costs of readiness in a way that is accessible to voters and accountable to taxpayers.

The larger arc surrounding the referendum, therefore, is not solely about a tax increase. It is about how a community builds and maintains a system that can deliver reliable emergency services while remaining faithful to the rule of law. It is about how residents exercise their constitutional right to participate in governance, how that participation is informed, and how the outcomes of those participatory processes shape future policy and budgeting decisions. It is about the moral and civic architecture that underpins a society where those who stand ready to respond to crisis are backed by a stable, lawful, and transparent funding framework. In short, the Pinellas Suncoast episode challenges us to think not only about what we fund, but how we fund it, and why the integrity of the process matters as much as the services themselves.

External readers may wish to consult the state’s official guidance on the framework within which special district referenda operate. For official guidance on the legal framework and procedural requirements, the Florida Division of Corporations offers resources that illuminate how such measures are structured within the state’s governance landscape. See https://www.floridasdiv.com for more information. Additionally, those interested in connecting practical safety concepts with governance considerations can explore accessible discussions of safety training and certification to better understand how preparedness translates into policy priorities and budget decisions. For practitioners seeking a narrative that ties training to public safety funding, consider resources that discuss safety essentials and professional development—these materials help bridge the gap between fiscal policy and on-the-ground readiness, illustrating how communities can invest in both people and systems to safeguard health and security.

The Referendum That Was Reconsidered: Reading the Pinellas Suncoast Fire and Rescue Debate Through a Community Lens

A local referendum can seem small in a region’s political life, a single question on a clock-faced ballot that appears to affect only a few figures in a budget spreadsheet. But when the Pinellas Suncoast Fire and Rescue District moved to raise property taxes to fund emergency services, the measure quickly took on larger meanings. It wasn’t merely about dollars and cents or the mechanics of a tax increase; it was about trust, governance, and what residents expect from the institutions charged with protecting their safety. The referendum, approved by voters at the ballot box in 2017, was overturned by a court ruling that cited irregularities in the process. The district chose not to appeal, and the decision effectively nullified the proposed tax increase. In the months and years that followed, the community faced a complex set of questions: What does it mean when a measure that seemed to reflect the community’s priorities is invalidated by legal procedures? How should residents interpret the absence of a funding increase for fire and rescue services when public safety remains a core local concern? And what does this sequence tell us about how a city or county’s governance works when the ballot box and the courtroom arrive at divergent conclusions about the public good?

The story begins with a straightforward premise. The Pinellas Suncoast Fire and Rescue District sought to expand its funding through a property tax increase. Supporters framed the measure as a necessary step to maintain and improve emergency response capabilities: faster response times, adequate staffing, and updated equipment that could keep pace with a growing and aging population. Opponents, meanwhile, warned about the risks of higher taxes in a period of fluctuating personal finances and uncertain economic conditions. They urged fiscal restraint and emphasized that a vote alone should not automatically translate into new obligations for residents without a robust demonstration of need and value. The tension between these positions is not unusual in local finance debates, but the subsequent legal outcome added weight to the larger conversation about how communities fund essential services in turbulent fiscal times.

When the court ruled that the referendum could not stand, it did more than invalidate a line item on a budget; it highlighted the fragile interface between democratic action and legal compliance. The court’s decision, the grounds of which were summarized in public reporting yet not fully detailed in every available source, suggested procedural flaws that had not been sufficiently addressed before the measure went to voters. A key consequence was that the district’s Board elected not to appeal. That choice is itself revealing. In many instances, public bodies appeal when a ruling appears to threaten a core policy direction or the ability to deliver promised services. The decision not to appeal can be read in several ways: a strategic calculation about the likelihood of success on appeal, a recognition that the costs of protracted litigation outweighed potential gains, or a principled stance about accepting the court’s interpretation of the process even when it means stepping back from a policy aim. The practical effect, regardless of motive, was to pause the forward motion of that particular funding mechanism and to place a renewed emphasis on the broader implications for emergency services in the district.

Within the community, the reaction to this moment has been varied and deeply felt. Those who supported the referendum faced disappointment and a sense that their voice had been partially overridden by what they perceived as a legalistic hurdle rather than a transparent public deliberation. They worried that without the funding increase, the quality and availability of emergency services could erode, or at least become more vulnerable to the pressures of aging infrastructure and rising expectations from residents who demand timely and reliable help in crises. They also voiced concern that the court ruling set a precedent that could chill future efforts to voice collective needs through the ballot. The fear is not merely about the immediate consequences of a potential funding gap; it is about the longer arc of how residents participate in shaping essential services when legal rules govern the pathway to change.

Opponents of the tax increase, by contrast, celebrated the court’s decision as a check on spending and a reminder that public funds must be tied to clear, demonstrable needs. Their stance rests on deep principles of fiscal responsibility and local control. They argue that communities should not expand their tax burden without thorough justification and a transparent demonstration of how the extra money would translate into tangible benefits. The court ruling, in this interpretation, validated concerns about budgetary oversight and the necessity of safeguarding residents against what they see as potential overreach in tax policy. The emotional and political dynamic here is not simply a debate over a line on a tax bill; it is a contest over how much authority residents should grant to local governments to tax themselves, and under what standards such authority should be exercised.

Beyond the immediate political dichotomy, the episode sparked broader discussions about transparency and accountability. A central question became how the district communicates with the public about its fiscal needs and the intended use of any new revenues. Several community members urged the district to improve clarity around ballot language, the specific calculations behind proposed increases, and the mechanisms for ongoing oversight once funding is approved. They argued that even a well-meaning proposal can be undermined by ambiguities that leave residents uncertain about what they are voting for and how the money will be tracked and reported. In this sense, the referendum’s overturning highlighted a governance problem that many communities encounter: when people decide to invest more in public safety, they want to be assured that those funds will be used as promised and that the decision-making process is open to public scrutiny and correction if needed.

What does all of this imply for how the Pinellas Suncoast Fire and Rescue District operates in a practical sense? Most immediately, the absence of a funding increase means the district must find alternative paths to meet the same guardrails of service delivery that supporters believed the tax increase would address. Those in favor of stronger services may point to potential reforms in revenue generation that are more broadly acceptable to the public, or to efficiency measures within the existing budget that could free up resources without new taxes. They might also advocate for phased or tiered approaches to funding, where incremental investments in critical areas—such as staffing during peak hours, additional training, or predictive maintenance for essential gear—are pursued alongside more transparent reporting processes. The core idea is not to abandon the goal of robust emergency services but to reframe the strategy so that it aligns with public acceptance and the legal constraints that govern how funds can be raised and spent.

For the opponents, the outcome reinforces the belief that local governance should adhere to the tested boundaries of fiscal discipline. They may see opportunities to emphasize efficiency, to scrutinize programs for duplications, or to pursue targeted funding that directly ties to measurable outcomes. The debate, in their view, should translate into a discipline of accountability—ensuring that any future request for new revenue is supported by clear, accessible metrics that residents can review, assess, and respond to at the ballot box. The lesson, from this vantage point, is not simply to advocate against tax increases but to insist on a standard of accountability that can reassure the public that any future measure is both necessary and responsibly managed.

The broader context of this chapter—drawing connections between governance, community trust, and the practical realities of emergency services—requires us to look at how the district and the community can move forward together. One path is to strengthen the channel of public engagement around safety needs. Town halls, public budget briefings, and accessible audit documents can help residents see the connections between the dollars proposed in ballot measures and the services they experience in emergencies. A culture of openness can also reduce the suspicion that sometimes accompanies controversial funding questions. When residents feel they have clear, direct access to information about why a proposed tax is needed, how funds will be allocated, and how results will be measured, the legitimacy of the public decision—whether to approve, modify, or reject a funding proposal—grows stronger.

Embedded in the discussion about transparency is a broader moral question about how communities conduct themselves when public safety is at stake. Fire and rescue services occupy a uniquely urgent position in the public imagination: the plea for readiness is a plea for more time, more readiness, and fewer moments when lives are in the balance. The social contract in such moments is sometimes tested not by the absence of will to improve safety but by the friction that appears when the means to fund improvement become contested. The narrative of the Pinellas Suncoast episode is therefore not merely a record of a legal decision; it is a case study in civic maturity. It invites a community to reflect on its willingness to balance risk, responsibility, and restraint—the three strands that tend to pull in different directions in a democracy when the stakes are high and the clock is ticking.

Within this frame, a single word often anchors the ongoing conversation: trust. Trust in the data that justify a new levy, trust in the governance structures that oversee how money is spent, and trust that the public voice will be honored even when a particular policy direction cannot proceed as initially imagined. The community’s task, then, becomes less about defending a preferred outcome and more about shaping a durable framework for decision-making that can withstand political and legal pressures while preserving the core aim of safeguarding lives. It is about creating a public sphere where people of differing views can come together, examine the facts, and navigate a path that respects both fiscal prudence and the imperative of public safety.

To that end, many residents looked to measures beyond the ballot to keep the conversation alive and productive. They urged the district to invest in better communication about the budget process, clarify how future requests would be crafted, and implement stronger oversight that can be observed by voters. They called for channeling controversy into constructive formats—more frequent updates, accessible financial dashboards, and opportunities for the community to weigh in well before a final vote. These suggestions echo a widely shared belief that governance is strongest when people feel informed, included, and able to participate in the shaping of services that directly affect their daily lives. In this sense, the Pinellas Suncoast episode can be reframed as an invitation to renew the social compact around emergency services: not a moment of defeat but a moment of recalibration, a reminder that public safety is a collective enterprise requiring ongoing stewardship, collaboration, and accountability.

In considering the ripple effects, it is essential to acknowledge that the implications extend beyond the district’s borders. Other municipalities and fire districts watching the case may draw lessons about how to frame ballot language, structure revenue questions, and communicate fiscal needs to a broad audience of residents. The experience underscores the delicate balance between empowering local bodies to address critical service gaps and ensuring that the public retains meaningful control over tax policy. It demonstrates why, in many jurisdictions, the design of a referendum—including the specificity of the measures, the clarity of the fiscal implications, and the safeguards against misinterpretation—matters as much as the policy outcome itself. If the goal is to preserve both public safety and public trust, the process must be as legible as the policy intention, and the results must be intelligible to the people who will ultimately carry the responsibility of funding and oversight.

Ultimately, the Pinellas Suncoast episode leaves a community with a more nuanced map of what a referendum can and cannot accomplish. The immediate policy objective may be paused, but the broader aspiration remains: to ensure that emergency services have the resources they need to respond quickly and effectively to crises. The path forward is not a single decision at the ballot box. It is a continuous practice of governance that blends prudent budgeting, transparent communication, and accountable oversight. In that sense, the referendum’s overturning may be understood not as a final verdict on public safety funding but as a catalyst for deeper public engagement and more thoughtful, collaborative ways to secure the safety net that residents rely on when every second counts. For readers seeking a broader sense of how these debates unfold in practical terms, the ongoing story is one of adaptation—how a district responds to a setback with renewed purpose and a community shapes reforms that align fiscal realities with the enduring imperative to protect lives. The lesson is clear: in local governance, the legitimacy of public safety investments depends as much on the clarity and inclusivity of the process as on the scale of the investment itself.

For readers who want to explore how transparency and public engagement shape safety outcomes in similar contexts, the broader range of related discussions in the community’s ongoing discourse offers a useful framework. In particular, one can look to resources that examine how safety officials articulate training, preparedness, and certification within a publicly funded system, as these components form the backbone of a credible safety culture. A useful entry point for such discussions is the Fire and Rescue blog that delves into foundational safety training and professional development, highlighting how individuals and departments build competency and accountability through structured programs. This reference provides complementary context to the governance-focused chapter and helps connect the dots between policy decisions and on-the-ground capabilities: Fire Safety Essentials Certification Training. While the specific training topics differ from the funding debate, they illuminate how communities cultivate capable responders and maintain public trust through ongoing investment in people and practices.

Looking back, the narrative of the Pinellas Suncoast referendum is not simply a record of a policy attempt and a legal reversal. It is a mirror held up to a community asking itself how it wants to balance the urgency of safety with the discipline of responsible governance. The court’s ruling and the district’s decision not to appeal reframe the conversation rather than end it. They invite residents to think about the mechanics of public funding as a continuous conversation rather than a one-off decision. They remind us that the legitimacy of any safety program hinges on the public’s perception that the process that creates it is fair, transparent, and accountable. In the end, what the referendum means is not only about whether a tax increase proceeds. It is about the community’s ability to imagine, debate, and steward the future of emergency services in a way that honors both fiscal integrity and the essential mission of protecting life and property when crises unfold.

External resource for additional context and coverage of the case can be found in reporting from local outlets that documented the decision and its aftermath. See the Belleair News overview of the court ruling and district actions for more background on the procedural aspects and the community response: https://www.belleairnews.com/2017/10/17/fire-district-wont-appeal-referendum-ruling/ .

Final thoughts

The Pinellas Suncoast Fire and Rescue referendum had long-term implications for community funding, legal processes, and resident engagement. Its nullification by the court underscores the complexities involved in local governance and the importance of adhering to legal standards when initiating referendums. Understanding these factors is crucial for stakeholders, especially individual car buyers, auto dealerships, and small business fleet buyers who rely on effective emergency services. Reflecting on the community’s response and the legal outcomes provides an essential perspective on future local funding initiatives.